Astrea 7 bond

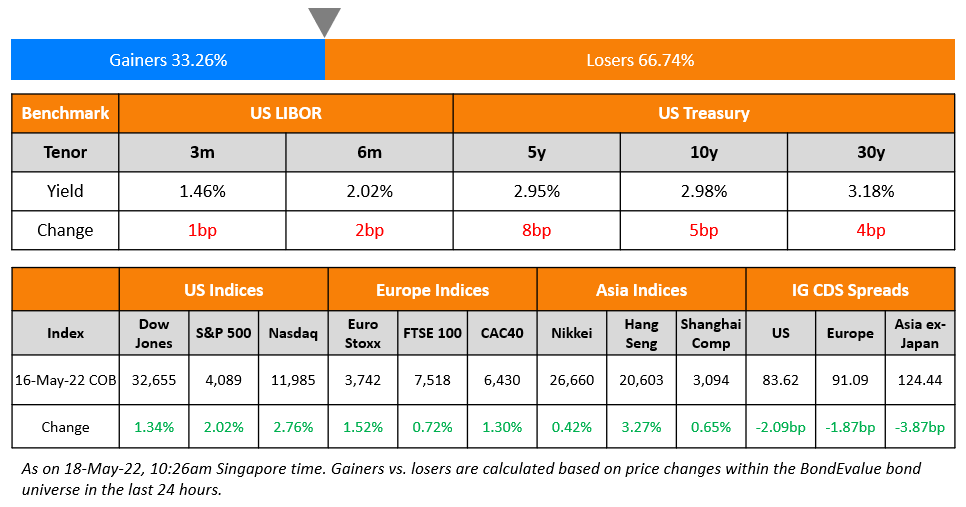

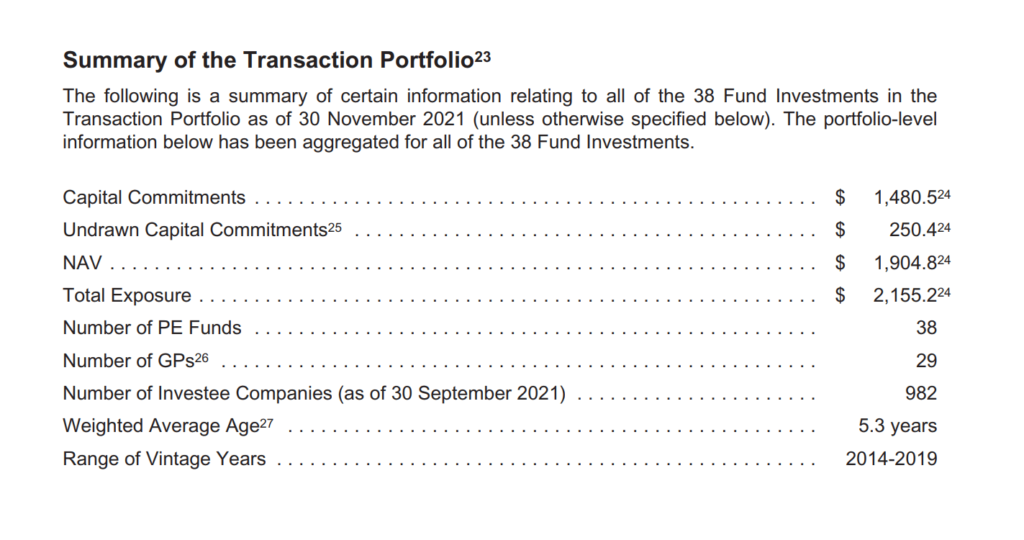

Class A-1 A-2 and B backed by cash flows from a US19 billion portfolio of investments in 38 Private Equity Funds. The resizing of tranches resulted in slightly more negative cash.

The size of the transaction is about 755mn or S105bn 396 of.

. Interest rates to be decided. The reallocation of class A bond principal did not result in a change to the cumulative LTV of Astrea 7s rated bonds. The proceeds will be used for refinancing of green assets according to its Green Financing Framework dated September 24.

It also reduces Copper Mercury Zinc Chlorine Cadmium and. Azaleas latest IG-rated PE bonds have been announced. Temaseks indirect subsidiary Azalea has launched an Astrea 7 bond backed by 38 Private Equity PE funds.

Astrea 7 is a. Temaseks Azalea launches Astrea 7 PE-backed bonds. Temasek-linked Astrea 7 is pricing three classes of private-equity bonds with public and institutional tranches according to a client note seen by Shenton Wire Wednesday.

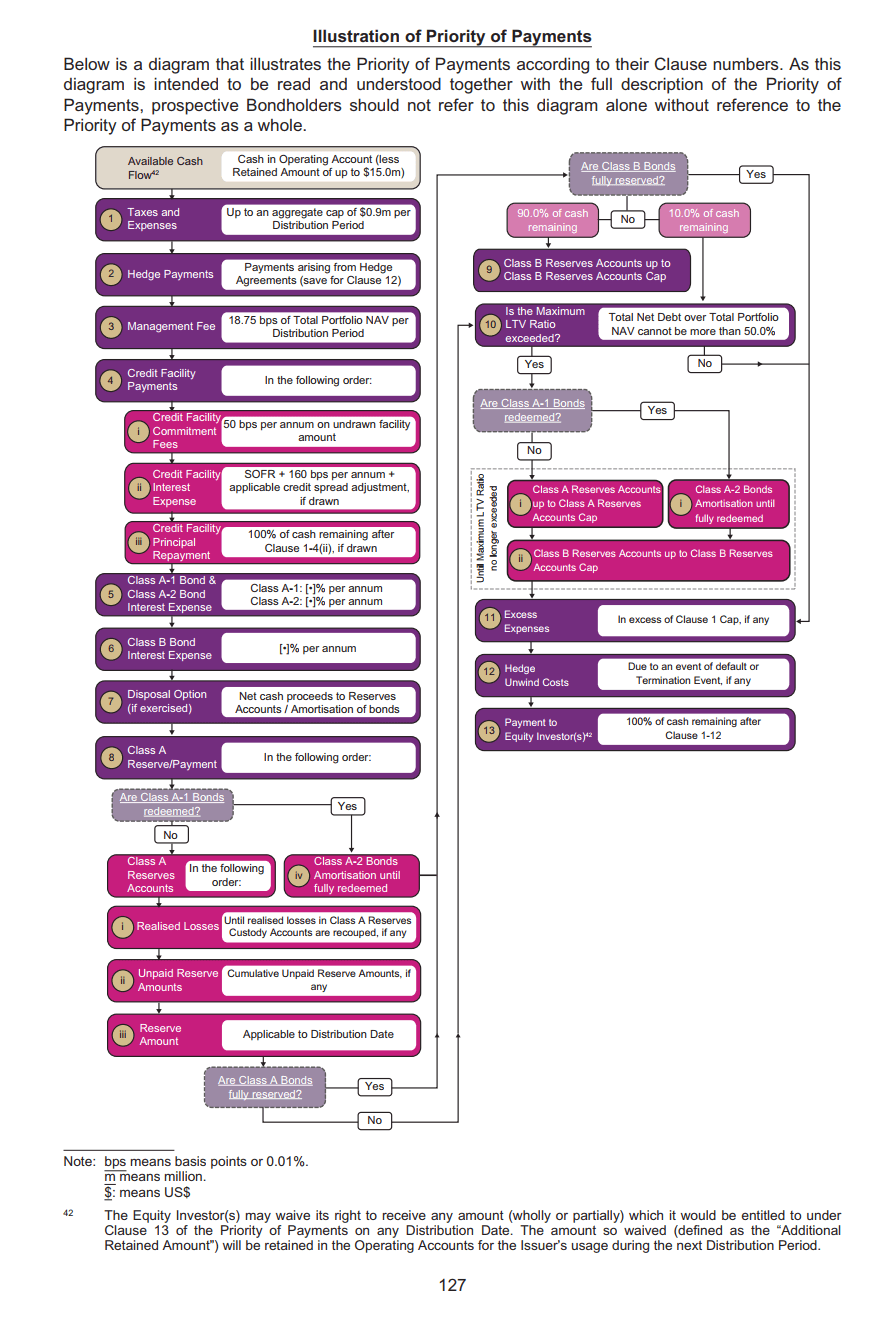

Astrea 7 PE Bond investors face typical risks such as default interest rate liquidity inflation risks exchange rate risks adverse macro-economic or market conditions including those arising. Similarly to the past launches there are three. AZALEA Asset Management an indirect subsidiary of Temasek.

Astrea is a series of bonds that are issued by a holding company that also held private equity funds as assets. Most likely the Astrea 5 bonds will be called back in 1 to 2 years. Singapore Airlines reports fiscal 2H net loss narrowed sharply.

Astrea 7 marks the seventh series of asset-backed securities offered by the Group and the cash flows are backed by a portfolio of 38 private equity PE funds with over 982 investee companies. Heres our latest update on the finalised yields. 11 hours agoThe public offer of Astrea 7 PE bonds comprises S280 million in Class A-1 bonds which pay a fixed interest rate of 4125 per cent per annum above the coupon for Class A-1.

Temaseks Azalea launches Astrea 7 PE-backed bonds. The bonds will rely on the cash flow from the underlying companies in the private equity funds to pay the interest coupon. Application will close on 25 May 2022 12pm.

The quantum is subject to change because. Singapore companies in focus on Thursday 19 May 2022. AZALEA Asset Management an indirect subsidiary of Temasek Holdings is launching a new series of bonds back by 38 private equity PE funds.

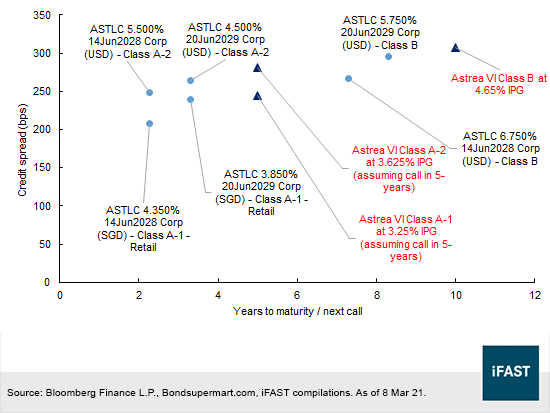

Bondsupermart 9 March 2021 In a simplistic way of looking at all three different private equity-backed retail bonds available to us we can tell that the market is pricing. Temaseks Azalea launches Astrea 7 PE-backed bonds. Astrea 7 offers three classes of bonds.

The astrea ONE filtering water bottle is the first to be certified to the NSF53 standard for lead reduction in drinking water. 6 hours agoToday Azalea Asset Management has released the Astrea 7 bonds for application. AZALEA Asset Management an indirect subsidiary of Temasek Holdings is launching.

In this issue of Astrea 7 the bonds is tied to 38 PE private equity funds. Interest rates to be decided. Astrea 7 or the issuer as seen in the table above.

The bonds received orders over 3bn 6x issue size. Out of a total indicative size of USD 755m Class A-1 bonds will have an allocation of USD 380m SGD 526m while Class A-2 and B will have a. It is offering 277 million of Class A-1 Bonds and US100 million 138 million of Class B Bonds to retail investors in Singapore.

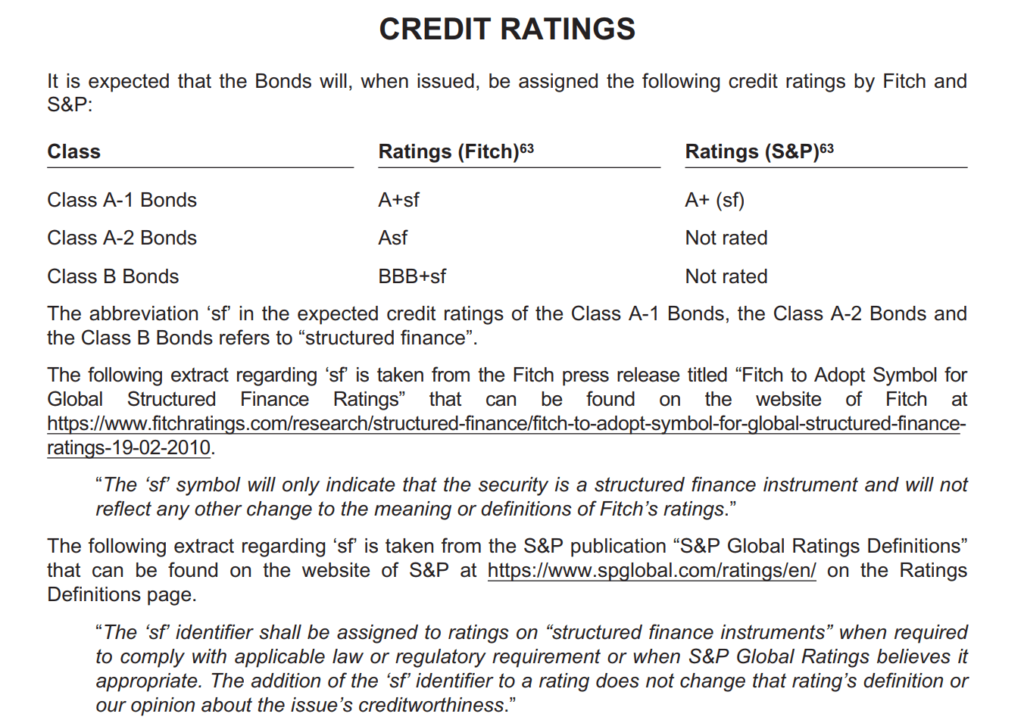

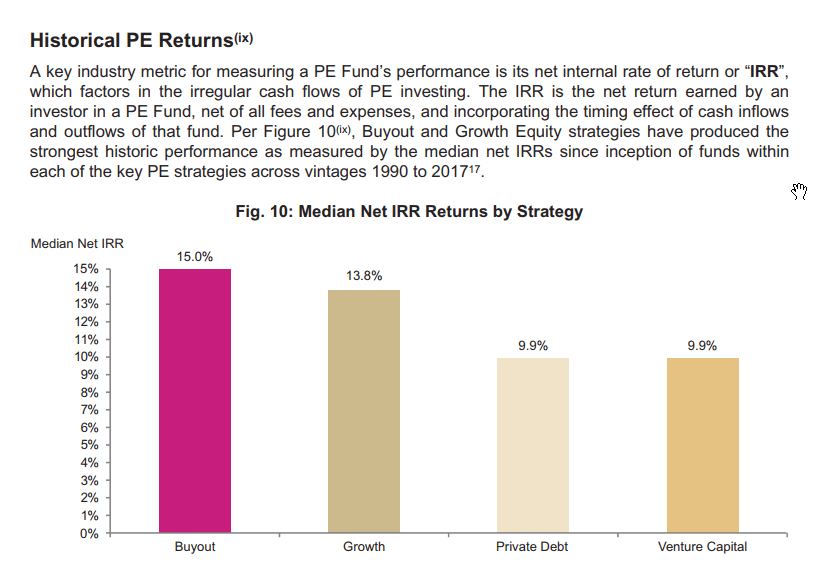

Astrea V 385 for Class A-1. I noticed that the credit quality of Astrea 7 Class A-2 and B are lower than the Astrea 5 issue based on Fitch. Astrea 7 offers three classes of bonds.

Astrea 7 Pte. Fitch Ratings expects to rate the class A-1 A-2 and B bonds to be issued by Astrea 7 Pte. Temasek-linked Astrea 7 pricing bonds.

The indicative total size. Class A-1 A-2 and B backed by cash flows from a US19 billion portfolio of investments in 38 Private Equity Funds Total issue size of US755m against a Transaction Portfolio NAV of US19bn. Interest rates to be decided AZALEA Asset Management an indirect subsidiary of Temasek Holdings is launching a new series of.

Astrea Vi Bonds At 3 Per Annum To Buy Or Not To Buy

Astrea V Bond What Singaporeans Need To Know

Temasek S Astrea V Targets Us 600 Million For Its Pe Bond Track Live Bond Prices Online With Bondevalue App

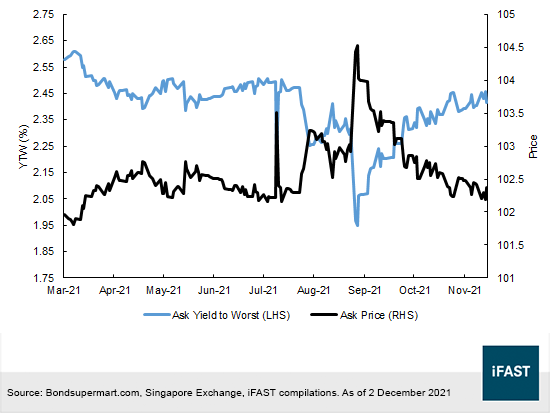

Astrea Pe Bonds Are Still Going Strong Amidst The Omicron Selloff Bondsupermart

Temasek S Azalea Launches Astrea 7 Pe Backed Bonds Interest Rates To Be Decided Banking Finance The Business Times

Temasek S Astrea Vi Lining Up New Usd And Sgd Pe Backed Bond Offering Track Live Bond Prices Online With Bondevalue App Temasek Holdings

Azalea Launches Astrea 7 Pe Backed Bonds At Indicative 755mn Size

10 Powerful Misfit Of Demon King Academy Quotes Qta Demon King Misfits Demon

Astrea Vi Private Equity Bond 10 Things To Know Before Investing

Astrea Vi The Most Anticipated Pe Bond Offering For 2021 Has Been Announced Part 1 Bondsupermart