new mexico solar tax credit 2019

When the previous credit expired solar jobs fell 25 percent across New Mexico. In 2020 New Mexico lawmakers passed a statewide solar tax credit called the New Solar Market Development Income Tax Credit.

Airport Security Market Size Share Forecast Report 2022 2028 Airport Security Marketing Perimeter Security

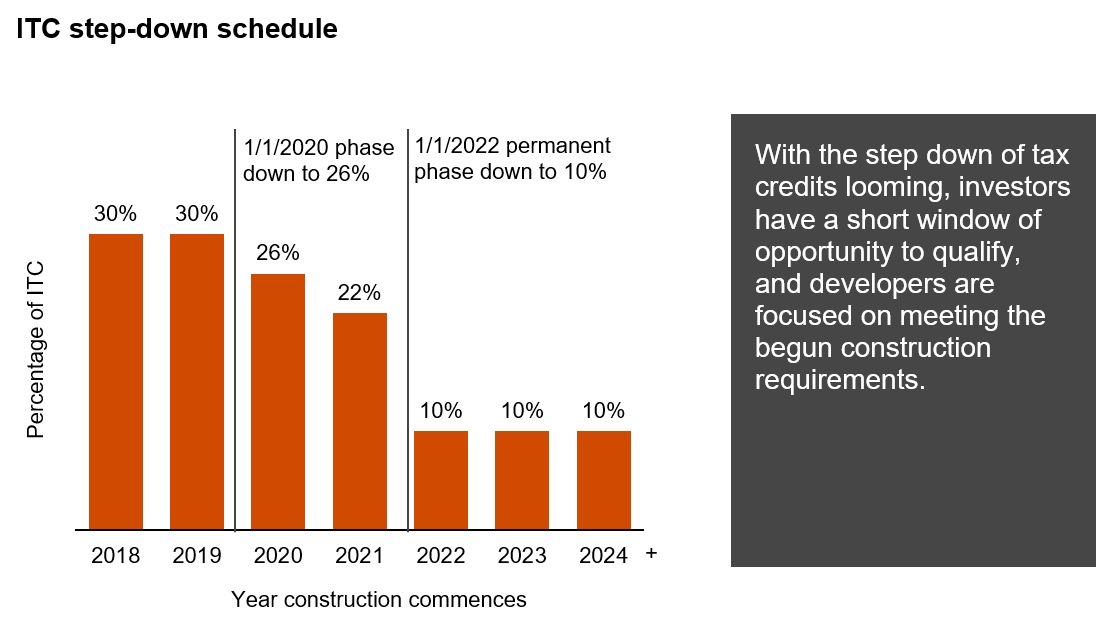

If you buy and install a solar system in 2019 youll claim a tax credit of 30 but if you wait till 2020 the tax credit will have reduced to 26.

. The home served by the system does not have to be the taxpayers principal residence. 10 of the costs of purchase and installation of your Solar PV system up to 9000. The credit could be up to 10 percent of the purchase and installation costs not to exceed 6000.

New Mexico offers state solar tax credits. Fuel cell property 30 for systems placed in service by 12312019. SignNow has paid close attention to iOS users and developed an application just for them.

Solar Market Development Tax Credit New Mexico provides a 10 personal income tax credit up to 9000 for residents and businesses non-corporate including agricultural enterprises who purchase and install certified photovoltaic PV and solar thermal systems. Senate Bill 29 sponsored by Sen. Ad Determine The Right Solar Power Company For You.

The credit is worth 30 of the systems cost up to 9000 and can be applied to individual or corporate income. 8 rows New Mexico Sustainable Building Tax Credit SBTC Qualify for up to 650 per built sq. This area of the site summarizes New Mexicos business-related tax credits and the procedures for claiming them.

The 10 tax credit which may be applied to solar installs for homeowners businesses and farms can. The federal government offers a 30 solar tax credit to boost investments in renewable energy. Ad Free New Mexico Solar Quotes.

However this amount cannot exceed 6000 USD per taxpayer in a financial year. There is a 26 federal tax credit available and there is no state tax that is paid on solar Gross receipts tax. So the ITC will be 26 in 2020 and 22 in 2021.

However the incentive will start to scale down at the end of the year. For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. The starting date for this tax credit is March 1 2020 and the tax credit runs through December 31 2027.

The Residential Solar Investment Tax Credit ITC for the total cost of solar installation goes until 2019 at 30. General types of tax credits are. 26 for systems placed in service after 12312019 and before 01012023.

Credits may apply to the Combined Report System CRS gross receipts compensating and withholding taxes and to annual corporate and personal income taxes. This incentive can reduce your state tax payments by up to 6000 or 10 off your total solar energy expenses whichever is lower. NM State RE Tax Credits.

The bill would create an income tax credit for 10 percent of solar installations costs at a home or business for 10 years. Personal income tax credits. Mimi Stewart D-17 and Rep.

There is a cap of 8 million in tax credits to be issued every year on a. The price of solar installation has dropped drastically. Matthew McQueen D-50 would allow those who construct solar power facilities to apply for a tax credit from the State of New Mexico.

Ad Find Out What You Should Pay For Solar Panels Based On Recent Installs In Your ZIP Code. Calculate What System Size You Need And How Quickly It Will Pay For Itself After Rebates. The tax credit does not apply to solar water-heating property for swimming pools or hot tubs.

New Mexico state solar tax credit. If you buy and install a solar system in 2019 youll claim a tax credit of 30 but if you wait till 2020 the tax credit will have reduced to 26. New Mexico Solar Tax Credit.

You will then file for the tax credit with your tax return before April the following year using the Form 5695. New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers. Mimi Stewart D-17 and Rep.

How to make an electronic signature for the RPD 41317 2015 2019 Form on iOS new mexico solar tax credit formice like an iPhone or iPad easily create electronic signatures for signing a trd 41406 in PDF format. Read User Reviews See Our 1 Pick. Each year after it will decrease at a rate of 4 per year.

New Mexico provides a 10 personal income tax credit up to 9000 for individuals sole proprietorship businesses or one that is required or allowed to elect to file taxes using IRS Form 1040 and agricultural enterprises who purchase and install certified photovoltaic PV and solar thermal systems. The tax credit applies to residential commercial and agricultural installations. Eligible systems include grid-tied commercial PV systems off-grid and grid.

The federal solar tax credit. To find it go to the App Store and type. The 10 percent tax credit toward the purchase of a solar system is available to New Mexico residents and business owners with a 6000 cap per taxpayer per year.

New Mexico Solar Tax Credits You Probably Are Not Aware Of. Claiming Business-Related Tax Credits for Individuals and Businesses or form PIT-CR Non-Refundable Tax Credit Schedule. For instance if your New Mexico solar.

2022s Top Solar Power Companies. It covers 10 of your installation costs up to a maximum of 6000. In 2020 the solar tax credit drops down to 26 and then to 22 in 2021.

New Mexico provides a 10 personal income tax credit up to 9000 for individuals sole proprietorship businesses and agricultural enterprises who purchase and install certified photovoltaic PV and solar thermal systems. You can claim the credit for your primary residence vacation home and for either an existing. Adding in all of those factors we will typically save you 10-15 on your current bill but it depends on how much your current bill is and which utility company you have.

Therefore its essential to take advantage of the New Mexico solar tax credits before 2022 comes. Non-refundable credits can be used to reduce tax liability but if the tax due is reduced to 0 the balance of these credits is not refunded. In 2020 New Mexico lawmakers passed a statewide solar tax credit called the New Solar Market Development Income Tax Credit.

In the middle of the American southwest nestled between Texas and Arizona the Land of Enchantment could be the next state to embrace solar energy if the State Legislature approves Senate Bill 518. The Solar Market Development Tax Credit provides a tax credit of 10 for small solar systems including on-grid and off-grid PV systems and solar thermal systems. Senate Bill 29 sponsored by Sen.

Since most average sized 6kW systems cost about 18000 you can expect a credit of about 1800. Exit Full Screen. If your income is low enough that you dont owe income taxes then you wont qualify for the tax credit.

New Mexico has a lot of sunlight. Read Our Company Breakdowns. Schedule PIT-CR is used to claim non-refundable credits.

As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income. It is taken in the tax year that you complete your solar install.

The Ultimate 2020 Guide To California Solar Tax Credit And Incentives

Clean Power Continues To Stretch Its Cost Benefits Over Coal

Energies Free Full Text Solar Energy In The United States Development Challenges And Future Prospects Html

Solar Energy S Latest Record Breaker 5 Takeaways

Solar Power Statistics In Australia 2019 Sf Magazine

Guggenheim Solar Index Pv Magazine International

Australia Tru Electricity Utility Bill Template Fully Editable In Psd Format Bill Template Statement Template Utility Bill

Make The Most Of Solar Deals Pwc

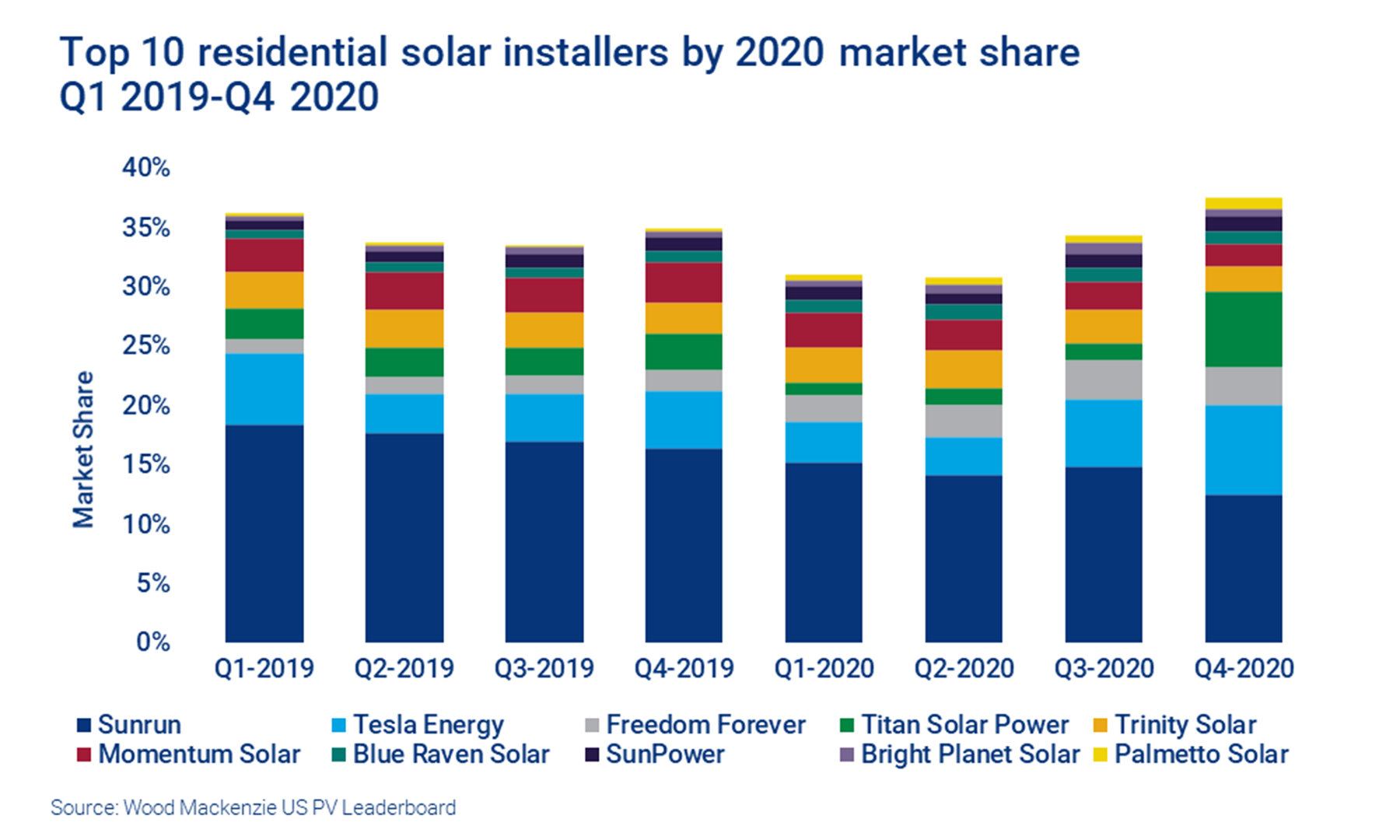

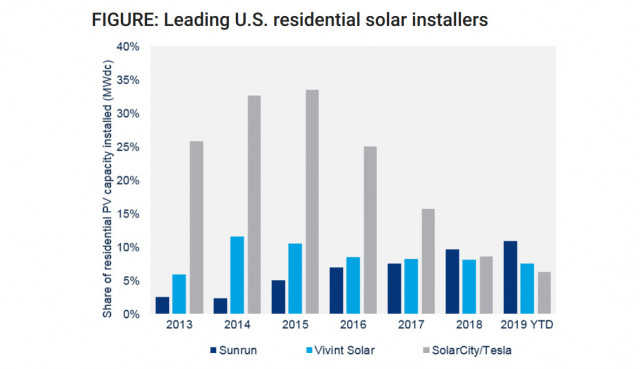

Sunrun Retains Its Title As Largest Residential Solar Installer In The Us Wood Mackenzie

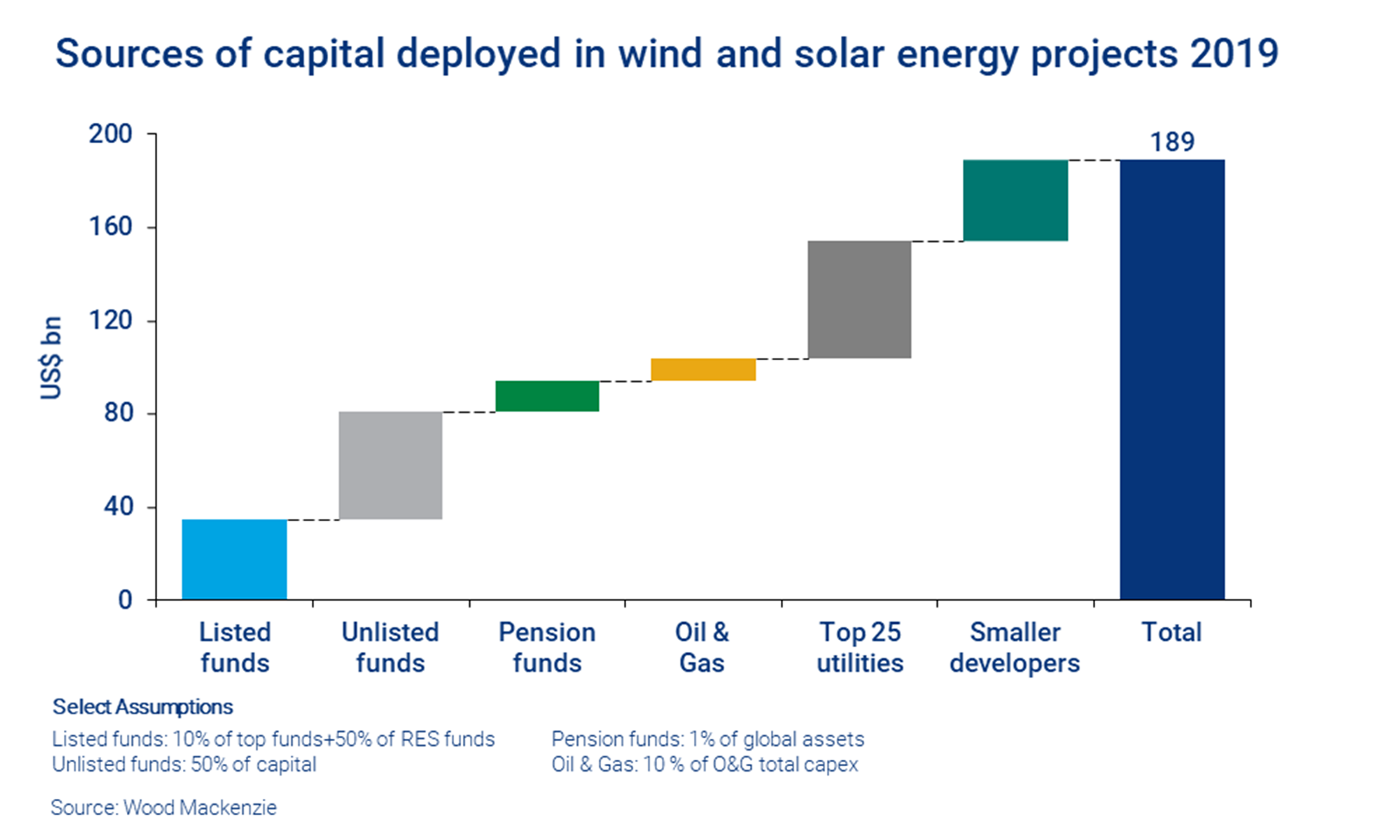

Show Me The Money Capital For A Renewables Future Wood Mackenzie

Tesla S Share Of The Home Solar Market Continues To Slide

How To Calculate The Federal Solar Investment Tax Credit Duke Energy Sustainable Solutions

Guggenheim Solar Index Pv Magazine International

Guggenheim Solar Index Pv Magazine International

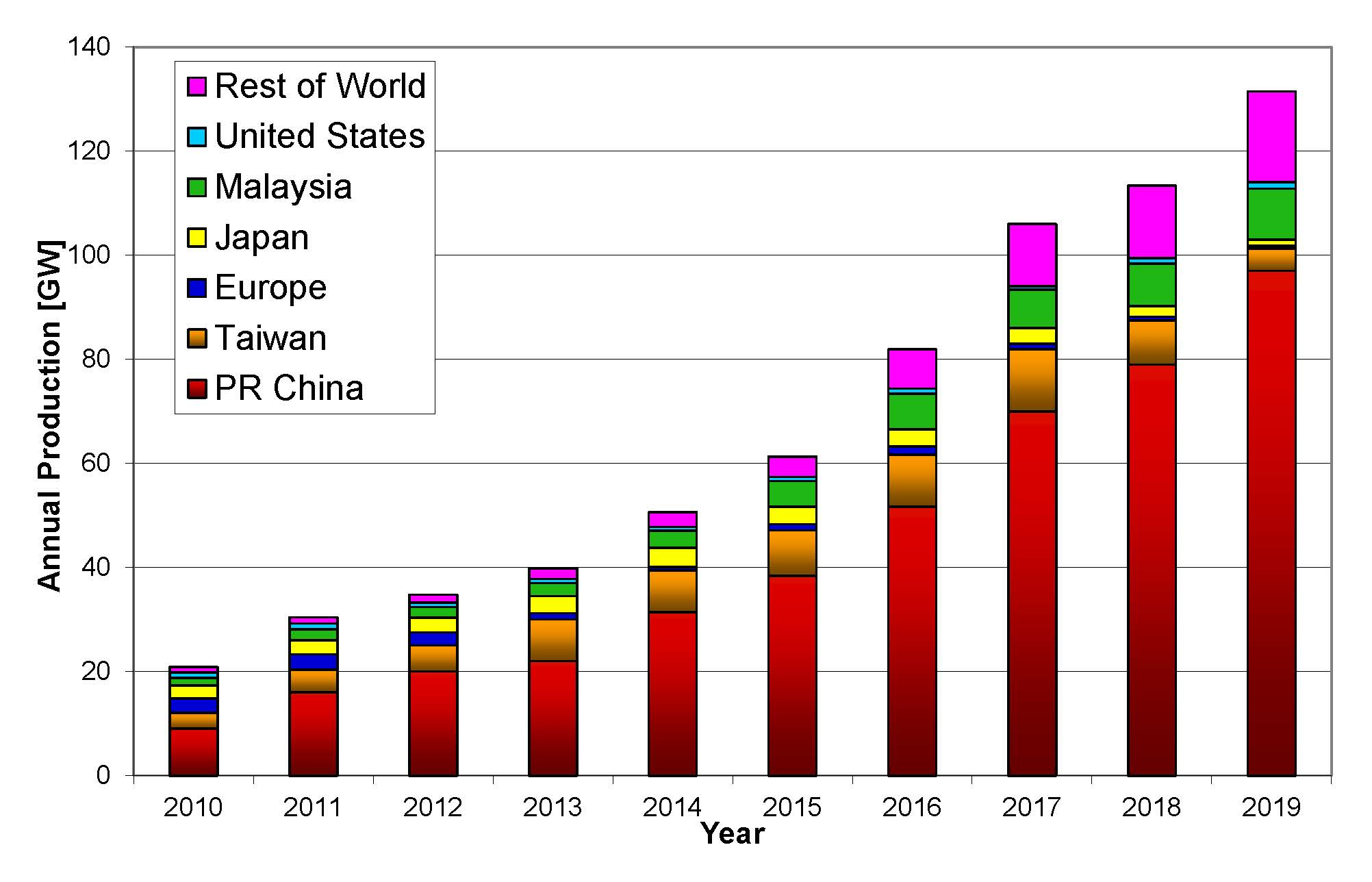

Solar Energy S Latest Record Breaker 5 Takeaways

Guggenheim Solar Index Pv Magazine International

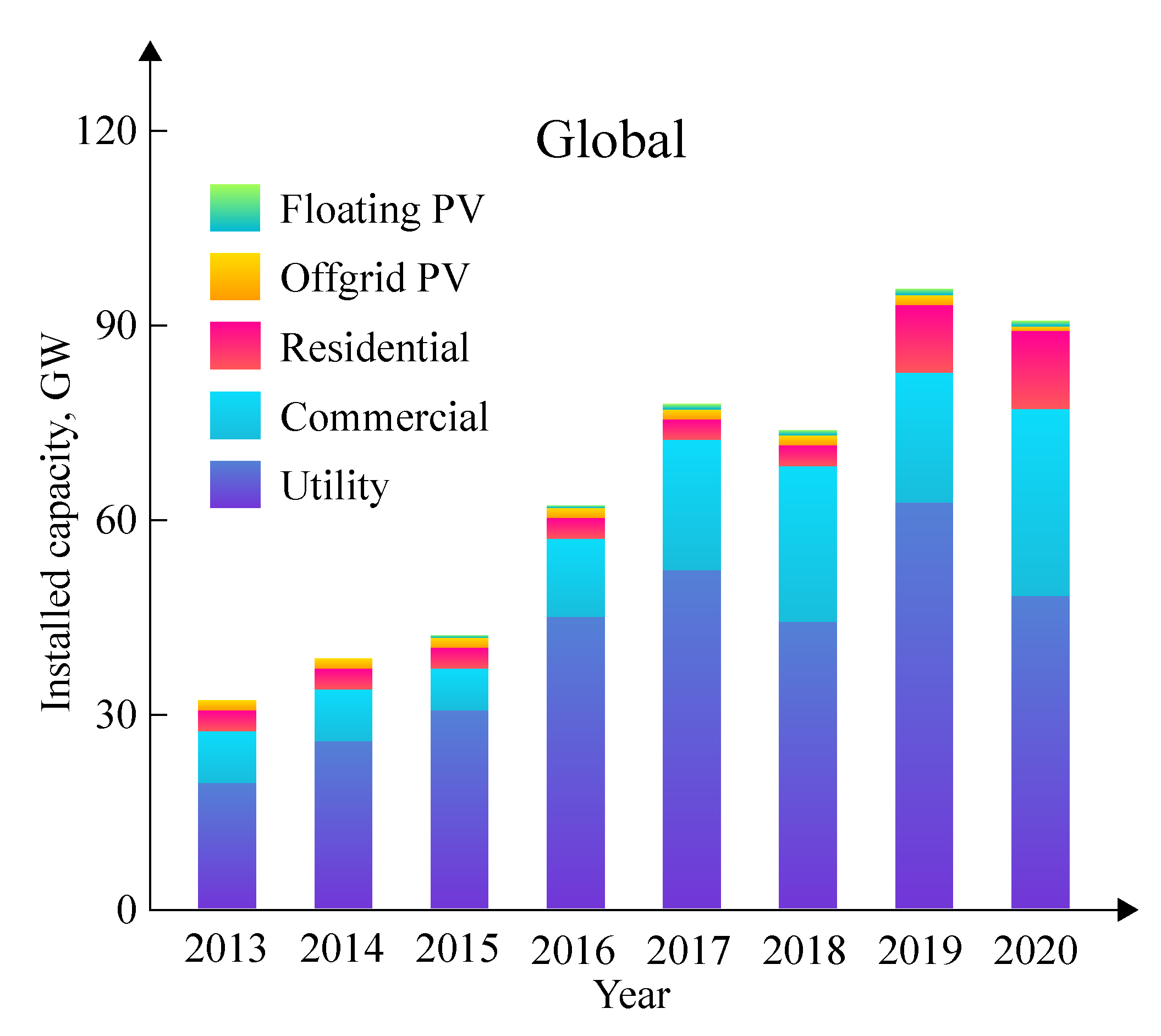

Energies Free Full Text Snapshot Of Photovoltaics February 2020 Html

Investment Tax Credit For Solar Power Solar Tax Credits Solar Power